Smarter Lending Decisions in Minutes

Our Solutions at a Glance

Flexible, scalable platforms designed for every stage of commercial lending.

Complete Commercial Loan Systems

End-to-end loan origination, financial spreading, and compliance reporting. Built for credit analysts, underwriters, and decision-makers who need fast, accurate results.

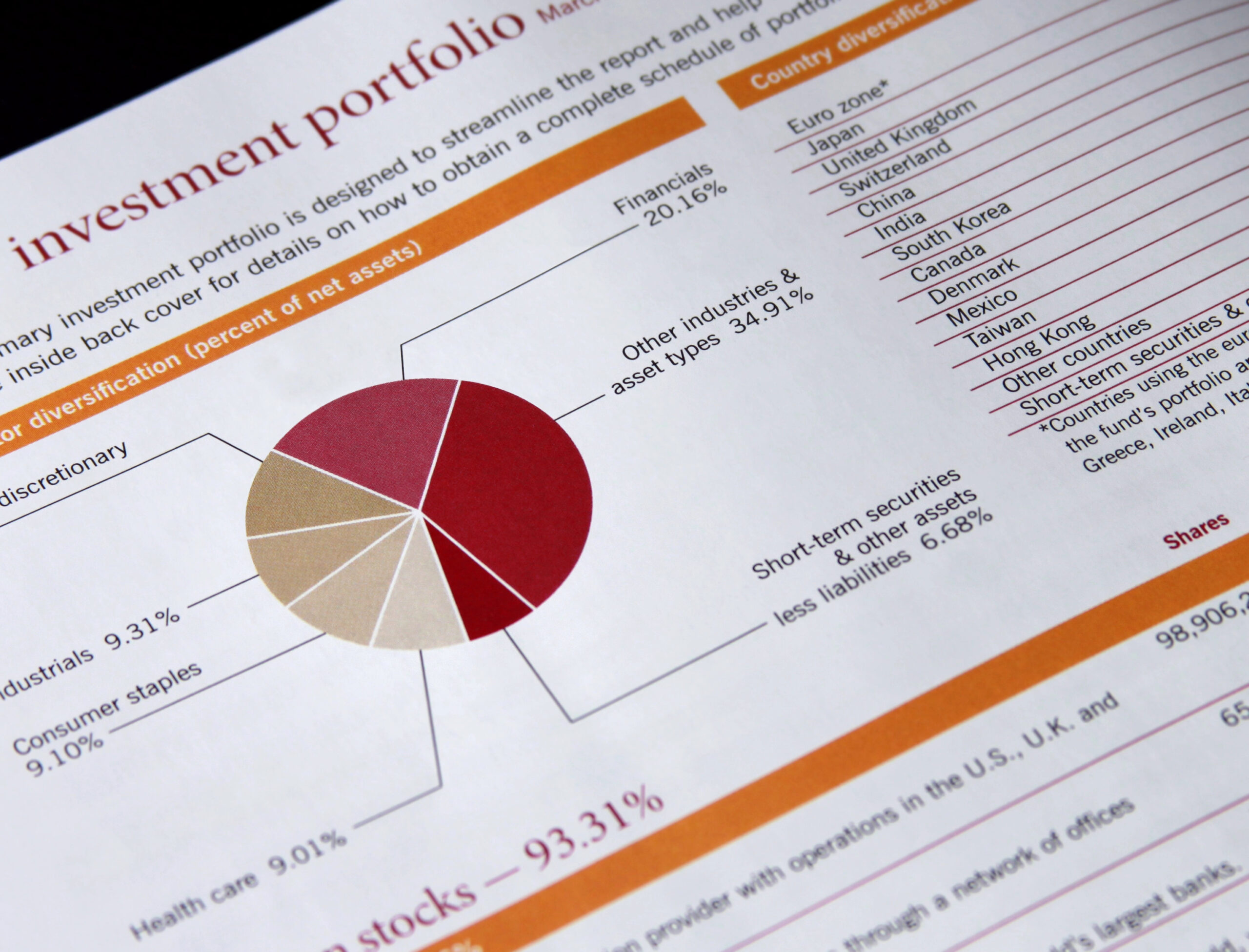

Advanced Portfolio & Stress Testing

Monitor, analyze, and forecast portfolio performance with AI-driven insights. Identify inconsistencies and manage risk with confidence.

Commercial Real Estate Decisioning

A dedicated platform for real estate–related lending. Simplifies property-level underwriting and delivers accurate credit assessments.

Secure, Compliant, and Built on Trust

Compliant & Secure

FDIC, NCUA, and SSAE 16 certified. Multi-layer encryption ensures your data stays protected.

Affordable and Agile

Clarity For All

Tailored Lending Solutions for Every Institution

Portfolio Analysis & Stress Testing 10x Faster with Automated Precision

Import Financial Data Instantly

Drag and drop borrower financials. The system automatically extracts and structures data, eliminating the need for manual input.

Run Smart Risk Analysis

AI-powered models instantly score borrower risk, highlighting trends and red flags in real time.

Generate Instant Reports

Comprehensive loan summaries, ratios, risk, and board-ready presentations — all automatically generated and approval-ready.

Notify & Close with Confidence

Approval or decline letters are created and sent securely — keeping compliance, speed, and accuracy perfectly aligned.

Request More Information

See for yourself how Cloudecision helps you make clear risk management decisions.

A Cloudecision specialist will contact you within one business day.

Once submitted, our team will reach out to schedule your personalized demo.