Effective CCAR Compliance for Today’s Financial Institutions

Effective CRE Risk Management and Compliance for Lending Institutions

January 23, 2017

Community Bank Silos: A Costly, Antiquated Concept

February 15, 2017

Financial institutions are inundated with existing loan data generated across numerous platforms. While the historical tendency to create silos was reinforced by IT systems already in place to serve individual departments, changes in the Comprehensive Capital Analysis and Review (CCAR) have highlighted the difficulties associated with such an approach.

CCAR as Tool to Improve Solvency

The CCAR contains federal regulations that apply to a broad spectrum of financial institutions within the United States. For example, banks and credit unions of all sizes are subjected to the stress tests that are designed to both improve the competence of their capital as well as ensure the institution’s longevity under significant and severe disadvantages.

Providing the information mandated by CCAR includes a thorough plan that provides an accurate model inventory of the internal factors used to generate its capital projections. An additional form of documentation is one that details the process the financial institution uses to identify any potential risks and to ensure that it complies with the CCAR regulations.

Compliance and Assessment

Ensuring that a financial institution is compliant with CCAR relies on an environment of transparency that is difficult to accomplish using a silos of functions from legacy IT systems. Because CCAR was designed to help banks obtain a holistic assessment of their capital operations, they can also use the data generated to detect previously unknown defects in loan portfolios or other factors. Another benefit is that financial institutions are now better able to make business decisions based on multiple data points and manage their capital assets.

According to a report released by the Federal Reserve Bank in 2013, the pre-provision net revenue (PPNR) estimates of several banks were imprecise due to weak information systems that used inadequate predictive models riddled with data limitations.

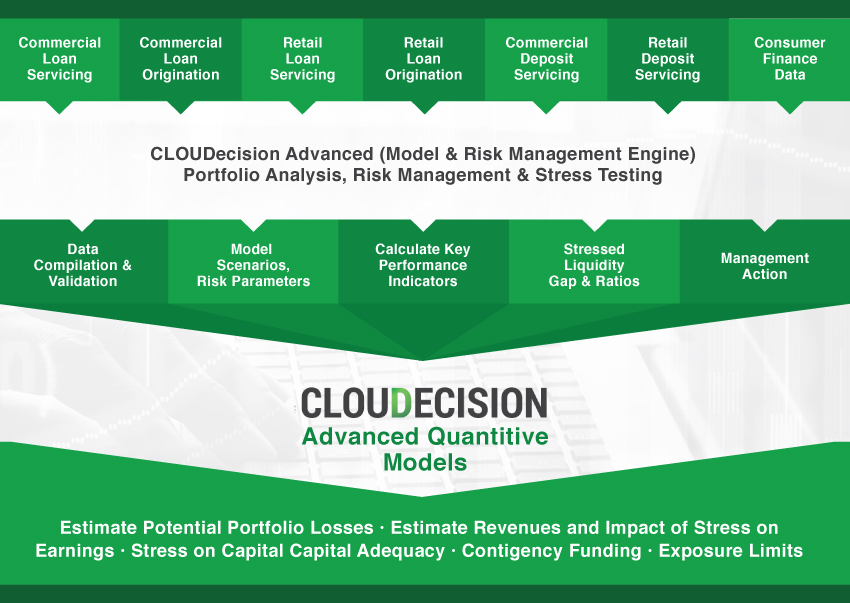

CLOUDecision Advanced provides the optimal solution for financial institutions searching for innovative, streamlined and affordable data solutions. Our Portfolio Analysis & Risk Management Suites offers the ability to quickly and effectively aggregate client data at multiple levels, and guarantee compliance with the latest regulations. Sign up for a free live demo today.