Community Bank Silos: A Costly, Antiquated Concept

Effective CCAR Compliance for Today’s Financial Institutions

February 6, 2017

Community Banks Fuel Strong Growth in Two Crucial Categories in 2017

March 6, 2017

The concept of silos of functions has been facilitated by the implementation of legacy IT systems that were designed solely to meet the demands of a particular department. While that might have seemed like a sound banking practice as recently as even decade or two ago, the financial landscape has changed dramatically since the financial crisis in 2008.

Indeed, it was silos of functions that exacerbated an already shaky financial profile for many financial institutions, according to Forbes, and that may have contributed to the downfall of some of the largest banks in the country.

CCAR Requirements and Today’s Community Bank

As a result of the collapse of the financial institution, the federal government instituted requirements — which are contained within the Comprehensive Capital Analysis and Review (CCAR) — that banks must meet in regards to their ability to access core data, as well as assembling consumer, retail and commercial data from differing systems into a central data warehouse. Within this warehouse, financial institutions must also prepare reports that meet regulatory reporting requirements, as well as financial and customer demands.

The Effects of Silos on Today’s Community Banks

Silos of functions tend to have an isolating effect in which one department of the financial institution is not aware of which is happening within another. While this approach might seem logical on the surface — each department specializes in those functions it knows best — the reality is that specialization should not come in isolation.

For today’s community banks to thrive and remain solvent, a method of accountability for each department — and the effects of its performance on the financial institution as a whole — must be implemented as soon as possible.

Compliance Solution

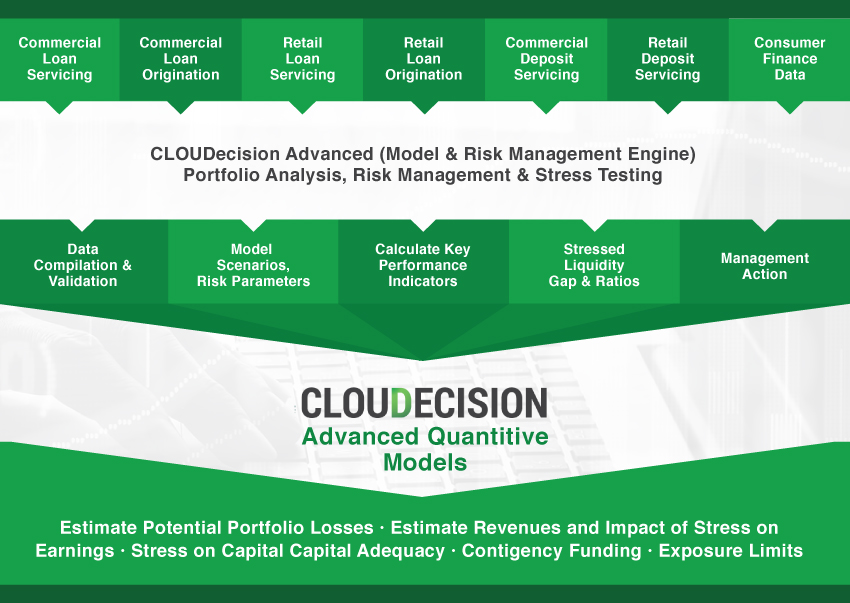

CLOUDecision Advanced offers comprehensive analysis functions, such as stress testing, portfolio analysis, and risk management, that are designed to help financial institutions meet CCAR requirements and ensure their long-term solvency. Our suite of solutions provide banks with the capability to aggregate client data at portfolio and individual loan levels so lenders have a clear understanding of every facet of CRE, C&I, and Consumer loans.

With CLOUDecision Advanced Quantitative Model, your bank has the capability to synthesize and address board and regulatory requirements including Estimate Potential Portfolio Losses, Loan Losses Adequacy Analysis, NAICS Concentration, Exposure Limit, Shock Test ADC and more. Contact us today for a free demo and learn how we can develop a customized solution for your financial institution’s needs.