Regulatory Changes and What It Means for Community Banks

Commercial Banking Risks and How to Stay Protected

September 28, 2016

How Community Banks Can Maintain Compliance Costs with Today’s Cloud-based software

October 19, 2016

Now more than ever, banks must demonstrate compliance with regulatory requirements for commercial lending. While big banks may have sophisticated software and the budget to easily handle changes, small banks often struggle to adapt to new regulations with old software. If your bank or credit union is experiencing difficulty keeping up with regulatory changes, CLOUDecision is exactly what you’re looking for.

Since BCBS 239, regulators have asked banks to deliver analytics and reporting on time while increasing the accuracy of data. Under the new rules, you cannot simply turn your data over to regulators and remain in compliance. You must be able to analyze data and make informed decisions in-house. The Federal Reserve has proposed a new measure which would force CFOs of financial institutions to sign off on data stress-testing reports.

Since BCBS 239, regulators have asked banks to deliver analytics and reporting on time while increasing the accuracy of data. Under the new rules, you cannot simply turn your data over to regulators and remain in compliance. You must be able to analyze data and make informed decisions in-house. The Federal Reserve has proposed a new measure which would force CFOs of financial institutions to sign off on data stress-testing reports.

The Writing is Clear

Banks and credit unions that do not have the right software for data analysis will not be able to keep up with the regulations. If you are not in compliance, your institution also faces the risk of penalties and fines that can affect day-to-day operations. If your bank is like most small, local banks, you’re either relying on legacy software to do much more than it can, or using spreadsheets that don’t have the ability to accurately analyze the data.

Comprehensive Solution for All

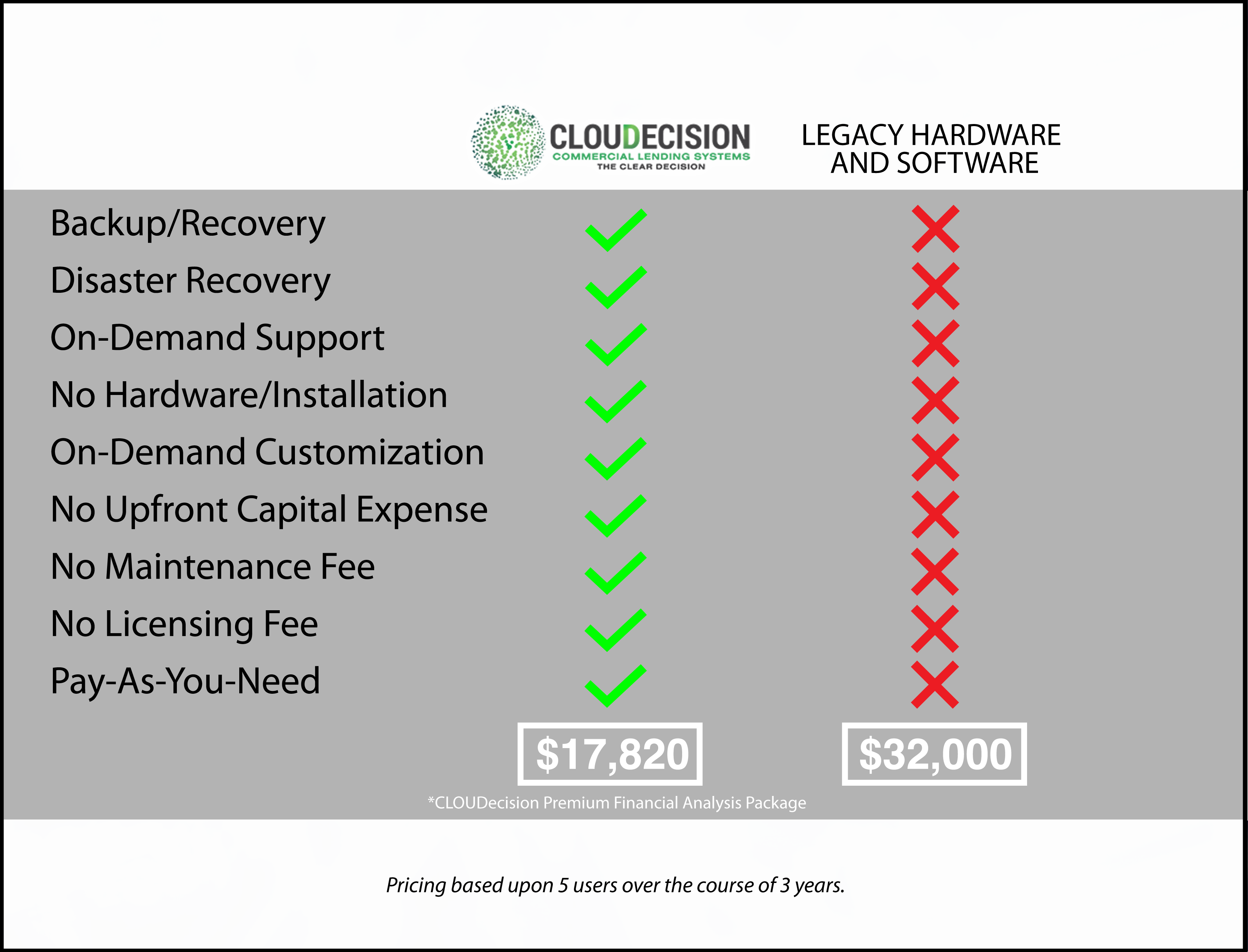

CLOUDecison provides regulatory-compliant software services designed for community banks and credit unions. It’s affordable, easy to learn, easy to use, and can be accessed 24/7 on any device.

With CLOUDecison Complete, you can easily run reports, analyze data, and demonstrate full compliance with strict data regulations in minutes. In addition, institutions have the ability to automate, integrate and share commercial loan data internally. Want to see how CLOUDecision can help you reduce risk and increase efficiency while remaining affordable and compliant? Contact us to sign up for a free demo.