Community Banks Fuel Strong Growth in Two Crucial Categories in 2017

Community Bank Silos: A Costly, Antiquated Concept

February 15, 2017

10 Questions CEO’s Ask About CLOUDecision

March 20, 2017

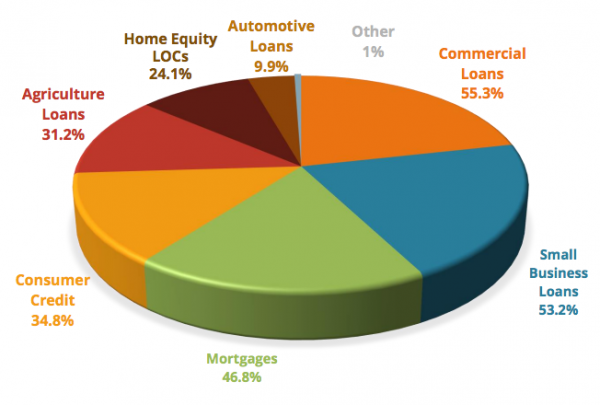

Financial institutions strive to maintain a balance of loan programs, and 2017 is shaping up to follow that trend according to a recent survey of today’s top banking officials. In fact, there are expectations of lending profitability and steady growth in two particular categories this year: commercial real estate and small business loans.

Opportunity for Growth

According to the banking executives surveyed, commercial loans are expected to show the most growth in 2017. This is followed closely by small business loans, with 53.2 percent of respondents predicting that they will experience a great deal of growth throughout the year.

The figures released by the FDIC for its third quarter report support this projection with community banks fueling that growth. With growth of nearly 3 percent over the prior year, small business loans rose. Loans to industrial and commercial entities also showed a great deal of strong growth and increased by $3.2 billion.

Lending Tools to Help Decision Makers

Community banks need to ensure that loan applications meet the criteria necessary for sound financial processes. Software solutions, such as CLOUDecision COMPLETE Commercial Loan Decisioning, provide CRE lending departments with the ability to confidently originate and underwrite loan applications. In addition, our versatile interface provides the flexibility to address commercial real estate loans for viability, allows for the production of individual loan stress testing, and more.

For small business loan departments, the ability to categorize loans helps with the management workflow from origination to the final decision. In addition, the software needs to offer a great deal of flexibility such as being able to override decision capabilities, generate customized presentation reports and manipulate approval thresholds. CLOUDecision Small Business Decisioning provides banks with these key features and more.

Customizable Software Solutions

For banks who want to take advantage of CRE and Small Business loan growth opportunities, a reliable software is essential. CLOUDecision takes the guesswork out of determining the viability of an application, and saves lending departments time when performing analysis and report development — ultimately increasing production and profitability of the institution.

For more information on how CLOUDecision can help your bank increase its performance and make smarter lending decisions, contact us today.