COMMERCIAL, MARKETPLACE & RISK MANAGEMENT

FOR BANKS, CREDIT UNIONS & PRIVATE LENDERS

1

1Compliant and Secure

FDIC and NCUA certified

Risk management starts with being regulatory compliant and SSAE 16 Certified. Rest assured that CLOUDecison is fully supported and secure – in fact we are more secure than most in-house data servers. 2

2Affordable and Agile

Worry-free back up and recovery

This is a game-changer for community banks and credit unions thanks to our flexible 24/7 on-demand system. Imagine no more annual licensing, maintenance fees, hardware or software to buy – ever. 3

3Clarity for All

Simple to Learn, Simple to Use

With our support & training, you’ll be able to see your portfolio like never before. Make clearer decisions with transparent choices. Board and Committee presentations are clear and easy to approve.REQUEST A FREE 15-MINUTE LIVE DEMO

See for yourself how CLOUDecision helps you make clear risk management decisions.

Our SaaS Packages

Additional SaaS Products

MarketPlace (MPL) Lending Systems: a state-of-the-art consumer lending workflow model

Advanced Portfolio & Stress Testing: source, analyze, monitor, and identify inconsistencies

Capital Stress Testing & Risk Management: use a combination of Commercial RE, Portfolio Analysis & Stress Testing, and Capital Stress Testing at a significantly lower cost

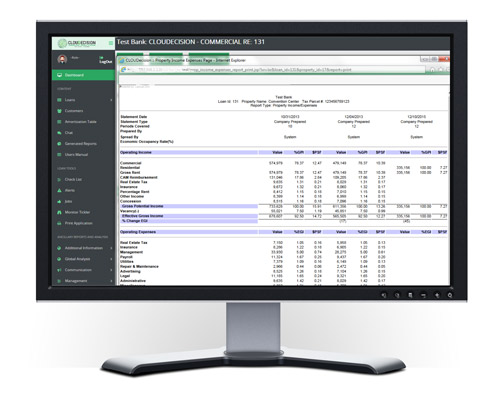

Commercial Real Estate Decisioning: originate and underwrite all real estate related loan applications

Small Business Decisioning: small business origination, underwriting, adoptive score cards and manual and auto decisioning

Construction Analytics & Draw Mgmt.: provides sources and usages of cash flow for C&I, A&D and Residential Properties

Consumer Finance Decisioning: a dynamic consumer lending workflow designed to meet your needs for all loan submissions

WE MAKE COMPLIANT AFFORDABLE.

At first, I thought that CLOUDecision would not be able to provide all the products and services that they claimed they could at the price they were quoting. I was very skeptical and waiting for the "catch". As it turned out, there was no "catch" and we have been very happy with their product.