3 Reasons to Reconsider Legacy Commercial Lending Software

SaaS Lending Software vs. Traditional Software

August 3, 2016Case Study: CLOUDecision & Cross River Bank

September 1, 2016

There are many differences between legacy and cloud-based software. One primary difference is that legacy software is installed on a server in a central location. Each computer within your company must then be linked to that server in order to access its programs. Cloud-based software is not physically housed in a location by a financial institution. However, loan officers are still able to access the information they need to evaluate commercial lending risk. In addition, there are several key reasons why cloud-based banking is a better alternative for banks and credit unions of the modern era.

1. There is no licensing cost and annual users maintenance cost

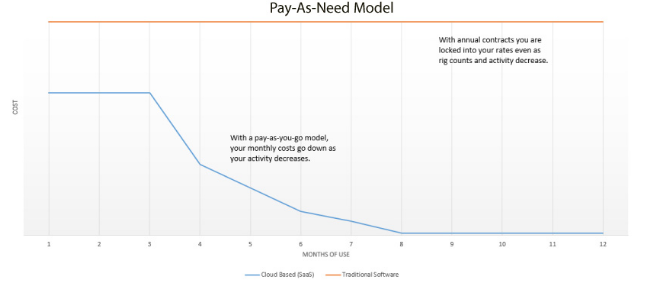

Legacy commercial software requires purchasing a license in order to use it. Additionally, there is a maintenance cost each year per user. Cloud-based software — also often referred to as SaaS — is structured in a way that provides the most savings to the financial institution. There is no licensing cost or annual users maintenance cost. Instead, the organization is authorized to use the software for a specified amount of time. Institutions only pay for the cloud-based software they are actually using. Because there are no licensing costs, more loan officers can access the information without accruing more fees.

2. SaaS provides constant backup/recovery and disaster recovery

All components of the cloud-based software including the operating system, patches, applications and data, are located on a virtual server that is independent of any hardware. This information can then be backed up or copied to a data center that is located off-site within just a few minutes. Because each component of the SaaS doesn’t have to be independently reloaded, backup and recovery happens instantly and there is little to no effort needed on behalf of the financial institution.

Multiple levels of security also ensure hosted data is completely protected and compliant with federal regulations.

3. Simplified software updates

While it’s true that many of the updates for both legacy and cloud-based software might be the same, the way these are handled are quite different — often to the determent of completing loan applications within a timely manner in the case of legacy software. Traditional server updates are typically more time consuming. Updates for cloud-based software — often referred to as SaaS — occur behind the scenes, do not need to be handled by the bank’s internal IT team, and are more on-demand with no interruptions.

CLOUDecision provides innovative cloud-based software solutions designed with today’s enterprising financial institutions in mind. Our SaaS offerings are forward thinking, low maintenance and cost effective for bankers, credit unions and other financial institutions. For more information on how CLOUDecision can improve your business operations, contact us or schedule a free demo of the platform.