Tailored Financial Analysis Solutions Support Community Bank Lending

10 Questions CEO’s Ask About CLOUDecision

March 20, 2017

Achieve Greater Returns with Less Risk: C&I Lending

April 19, 2017

Recently, the chairman of the Independent Community Bankers of America, Rebecca Romero Rainey, highlighted the challenges faced by community banks. She stated, “One-size-fits-all regulations are imposing unnecessary burdens on community banks that stifle lending and growth in local communities.”

The practice of having community banks adhere to the same regulations as larger financial institutions is not new, nor is the common practice for lending departments to use outdated methods of analyzing financials. However, both practices ultimately result in a decrease in production and in turn reduce revenue opportunity for the bank.

Furthermore, community banks that utilize such one-size-fits-all lending practices aren’t providing good service to their communities — or to their boards.

Lending Practices Must Evolve

Banks that continue to use outdated methods of determining the legitimacy of a loan or that use outdated financial software to do so are risking far more than just implementing inefficient practices. These antiquated processes could also lead to overlooked red flags which alert lending officers to potentially unsound banking practices.

CLOUDecision Offers a Complete Solution Tailored for Today’s Community Lending Institutions

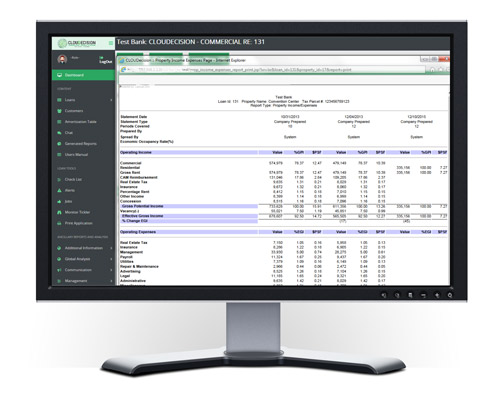

CLOUDecision Complete is the loan review and origination software that provides a robust, flexible and innovative solution for today’s community banks. Designed to make it easier and more efficient for lending officers to process loans and generate reports, CLOUDecision Complete enables you to tailor each facet of the loan origination process so it is unique to your bank.

Additionally, CLOUDecision nimbly provides bank employees with the financial information and tools they need to perform at optimal productivity. Each loan applicant receives secure, prompt service tailored to their request.

CLOUDecision Complete: Affordable Software Solutions That Meet Your Lending Needs

With CLOUDecision Complete, banks are able to:

With CLOUDecision Complete, banks are able to:

- Seamlessly retain control of lending practices

- Reduce costs

- Comply with all regulations at all times

- Customize and adapt innovative tools to create new loans or modify existing ones immediately

- Take advantage of low startup costs and pricing plans designed to provide continued value

- Increase effective productivity

- Cut back on expensive IT departments with continued support from the CLOUDecision team

- Streamline processes

- Slash expenditures

- Increase profits

CLOUDecision Complete is nimble commercial loan decisioning software that delivers robust features and results. Designed to streamline workflow across all types of loan vehicles, CLOUDecision Complete’s suite of features includes the ability to generate multiple management reports, share data internally, manage portfolios and more. Contact CLOUDecision today for more information or to sign up for a free live demo.